How's the Austin Real Estate Market?

“How’s the market?” is the question I’m asked most once people find out I work in real estate.

This page is a simple, no-hype resource for staying up to date on what’s actually happening in the Austin housing market — locally and nationally — without having to dig through headlines or guess what matters.

Each week, I share short updates that break down market trends, real numbers, and what they may (or may not) mean if you’re thinking about a move — now or down the road.

Monday Morning Market Update

Friday's Facts & Figures - Your Weekly Wrap on the Past 7 Days of Austin Real Estate

Local & National Market Notes

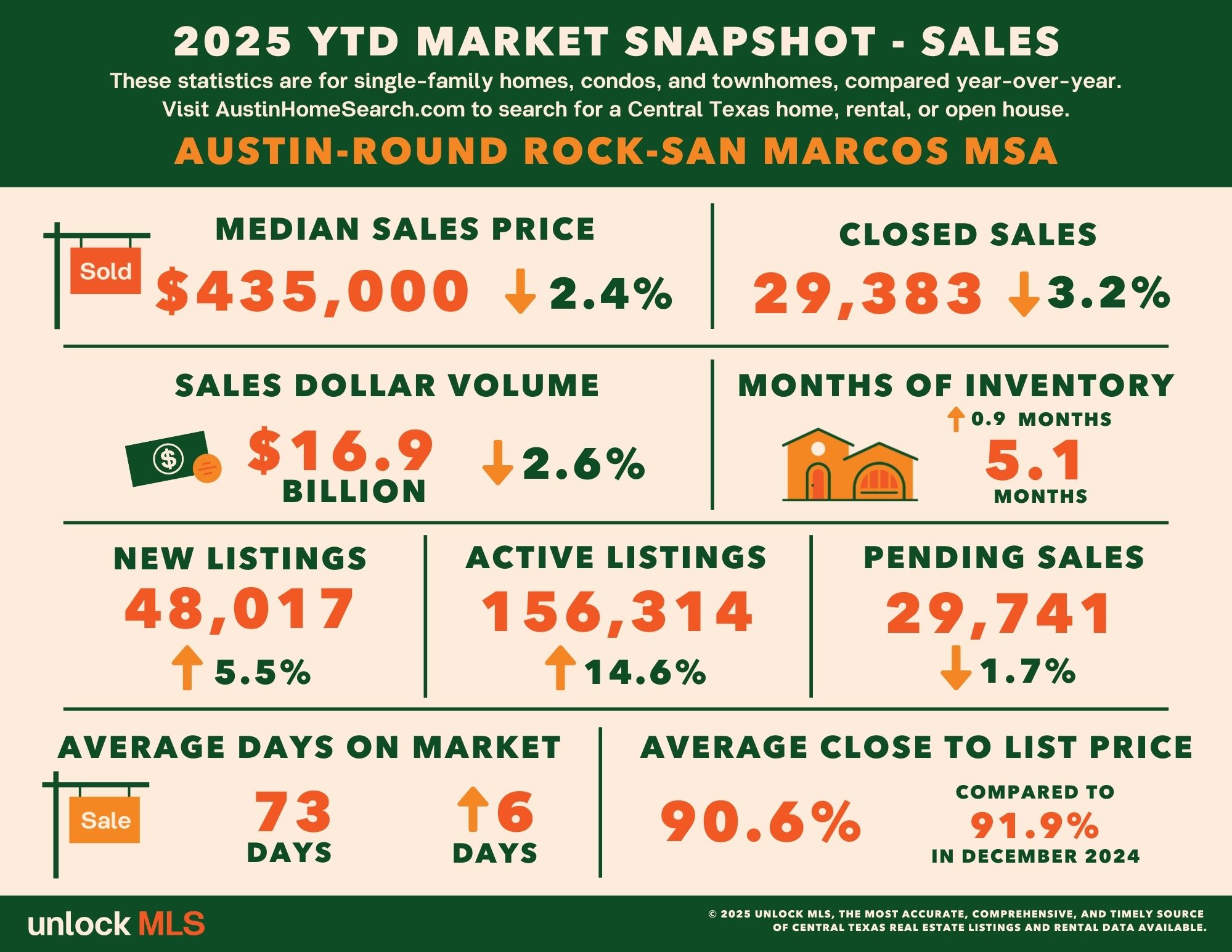

2025 Wrap-Up: Central Texas Market Settles into Long-Term Stability

It may not have been the flashiest year, but 2025 gave us something better: signs of a healthier, more balanced market. According to the year-end report from Unlock MLS, the Austin-Round Rock-San Marcos MSA ended the year with 29,383 closed sales - just a 3.2% dip from 2024. But here’s what matters: buyer activity picked up in the second half of the year, prices continued to normalize, and inventory found its footing after peaking midyear. In short, we wrapped up the year on steadier ground.

Vaike O’Grady, research advisor at Unlock MLS, summed it up well:

“2025 wasn’t a year defined by urgency. It was defined by adjustment. Early in the year, we saw the effects of rate sensitivity, price hesitations and a flood of new listings that pushed inventory higher. As the year went on, sellers recalibrated, buyers reengaged and the pace of the market continued to normalize. December 2025 numbers confirmed that shift. Homes sold at more realistic prices, inventory leveled out and buyers stayed active with more than 2,500 closed home sales–an increase compared to December 2024–even if they were moving more deliberately. That’s not a slowdown, it’s the foundation of a healthier, more sustainable market.”

Looking ahead to 2026? We’re likely to see more of the same—and that’s a good thing. Mortgage rates are projected to hover around 6%, home prices and sales should stay steady, and with improving affordability and a resilient job market, Central Texas is well-positioned to ride out national uncertainty while continuing to grow at a sustainable pace.

2025

29,383 – Residential homes sold, 3.2% less than 2024.

$435,000 – Median price for residential homes, 2.4% less than 2024.

48,017 – New home listings on the market, 5.5% more than 2024.

156,314 – Active home listings on the market, 14.6% more than 2024.

29,741 – Pending sales, 1.7% less than 2024.

$16,901,610,663 – Total dollar volume of homes sold, 2.6% less than 2024.

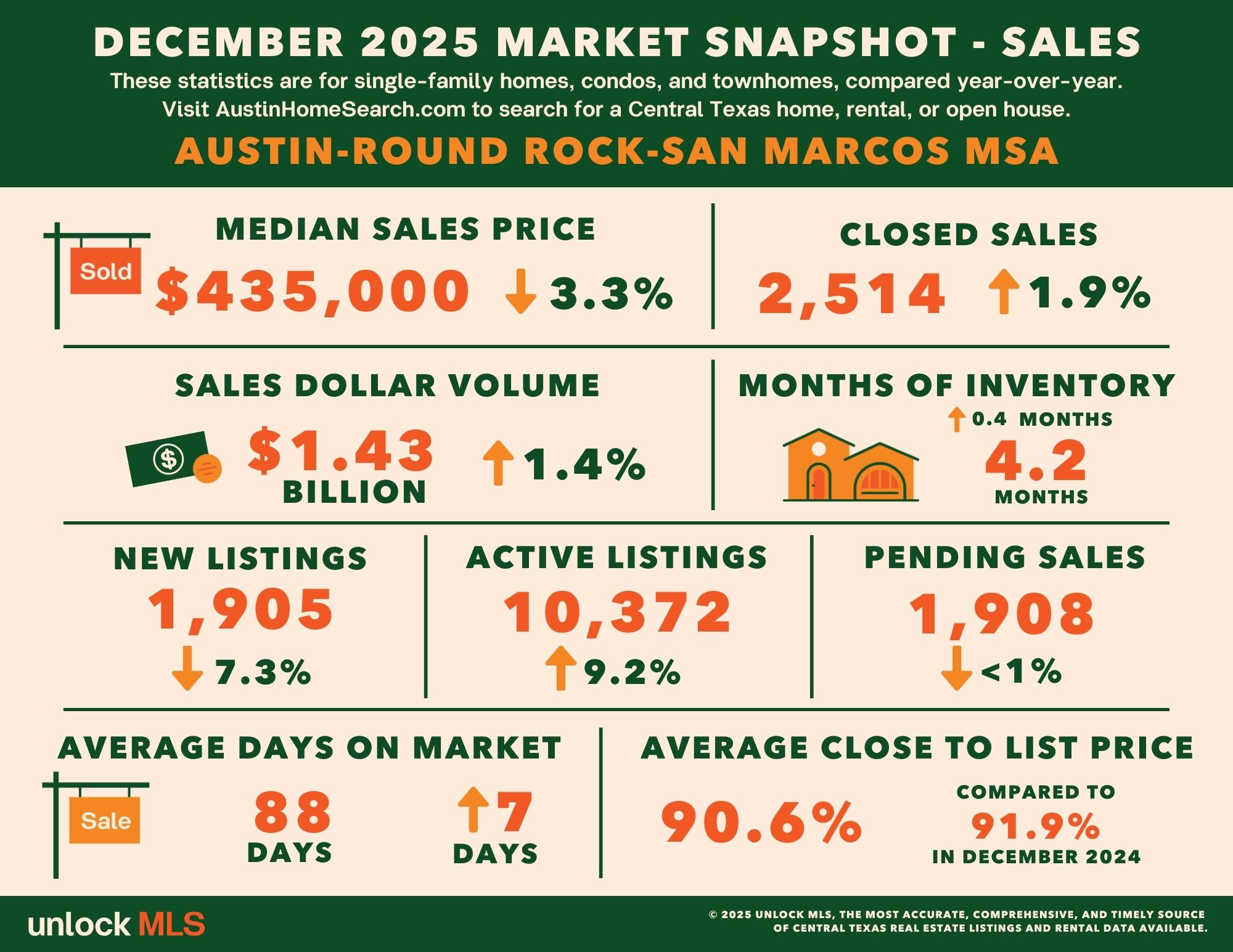

Austin-Round Rock-San Marcos MSA (December)

2,514 – Residential homes sold, 1.9% more than December 2024.

$435,000 – Median price for residential homes, 3.3% less than December 2024.

1,905 – New home listings on the market, 7.3% more than December 2024.

10,372 – Active home listings on the market, 9.2% more than December 2024.

1,908 – Pending sales, 0.2% less than December 2024.

4.2 – Months of inventory, 0.4 months more than December 2024.

$1,436,112,712 – Total dollar volume of homes sold, 1.4% more than December 2024.

90.6% – Average close to list price, compared to 91.9% in December 2024.

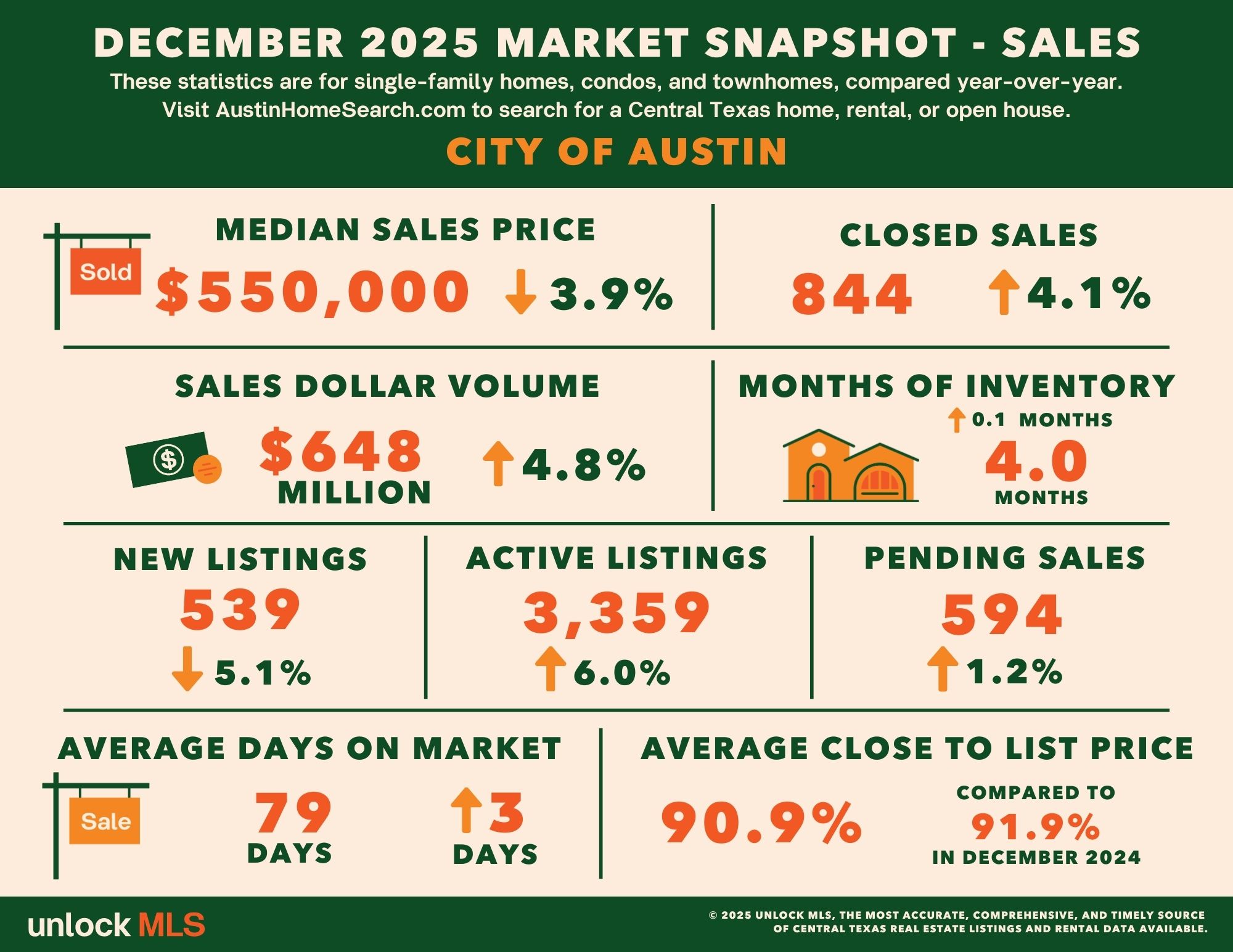

City of Austin (December)

844 – Residential homes sold, 4.1% more than December 2024.

$550,000 – Median price for residential homes, 3.9% less than December 2024.

539 – New home listings on the market, 5.1% less than December 2024.

3,359 – Active home listings on the market, 6.0% more than December 2024.

594 – Pending sales, 1.2% more than December 2024.

4.0 – Months of inventory, 0.1 months more than December 2024.

$648,723,194 – Total dollar volume of homes sold, 4.8% more than December 2024.

90.9% – Average close to list price, compared to 91.9% in December 2024.

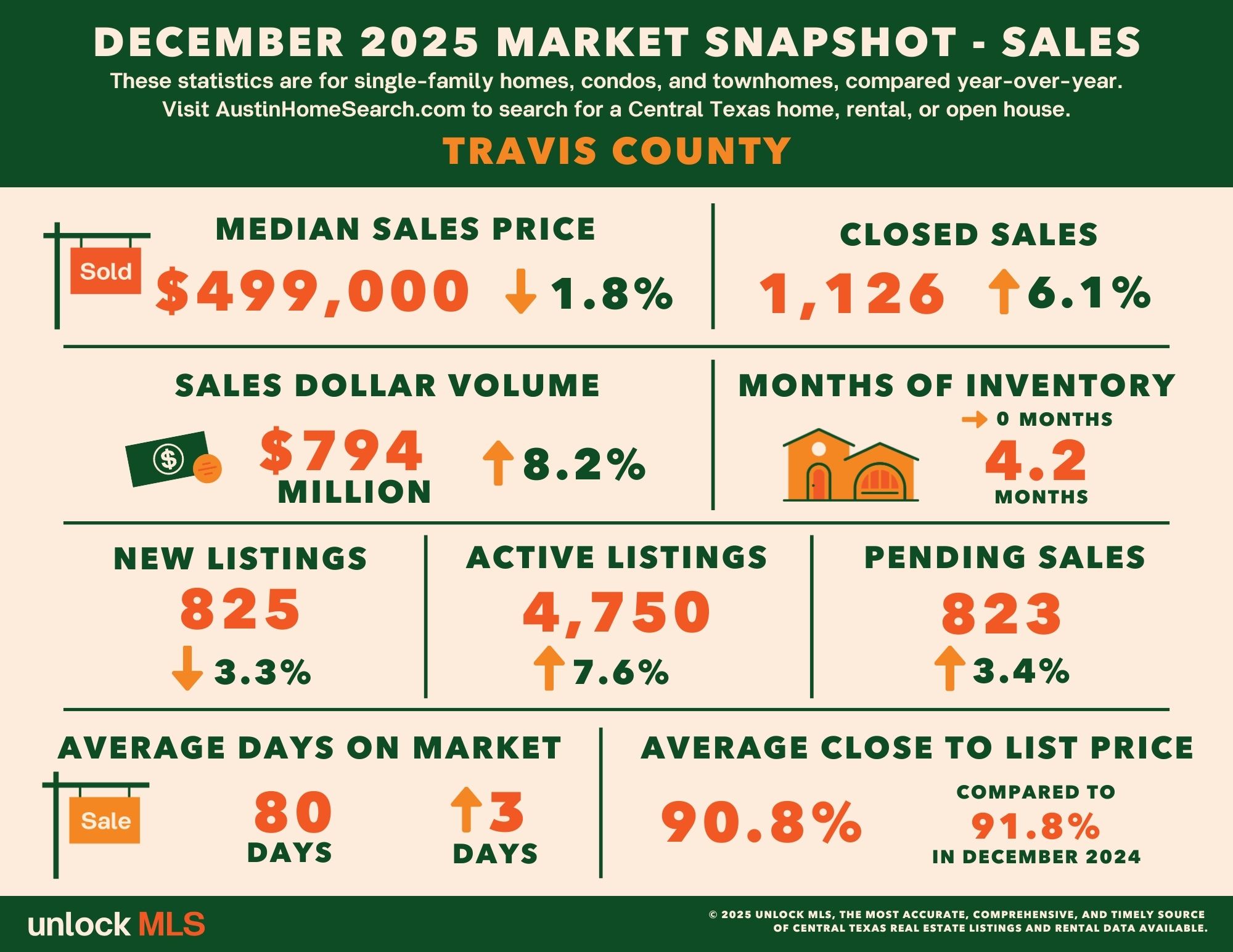

Travis County (December)

1,126 – Residential homes sold, 6.1% more than December 2024.

$499,000 – Median price for residential homes, 1.8% less than December 2024.

825 – New home listings on the market, 3.3% less than December 2024.

4,750 – Active home listings on the market, 7.6% more than December 2024.

823 – Pending sales, 3.4% more than December 2024.

4.2 – Months of inventory, flat compared to December 2024.

$794,753,537 – Total dollar volume of homes sold, 8.2% more than December 2024.

90.8% – Average close to list price, compared to 91.8% in December 2024.

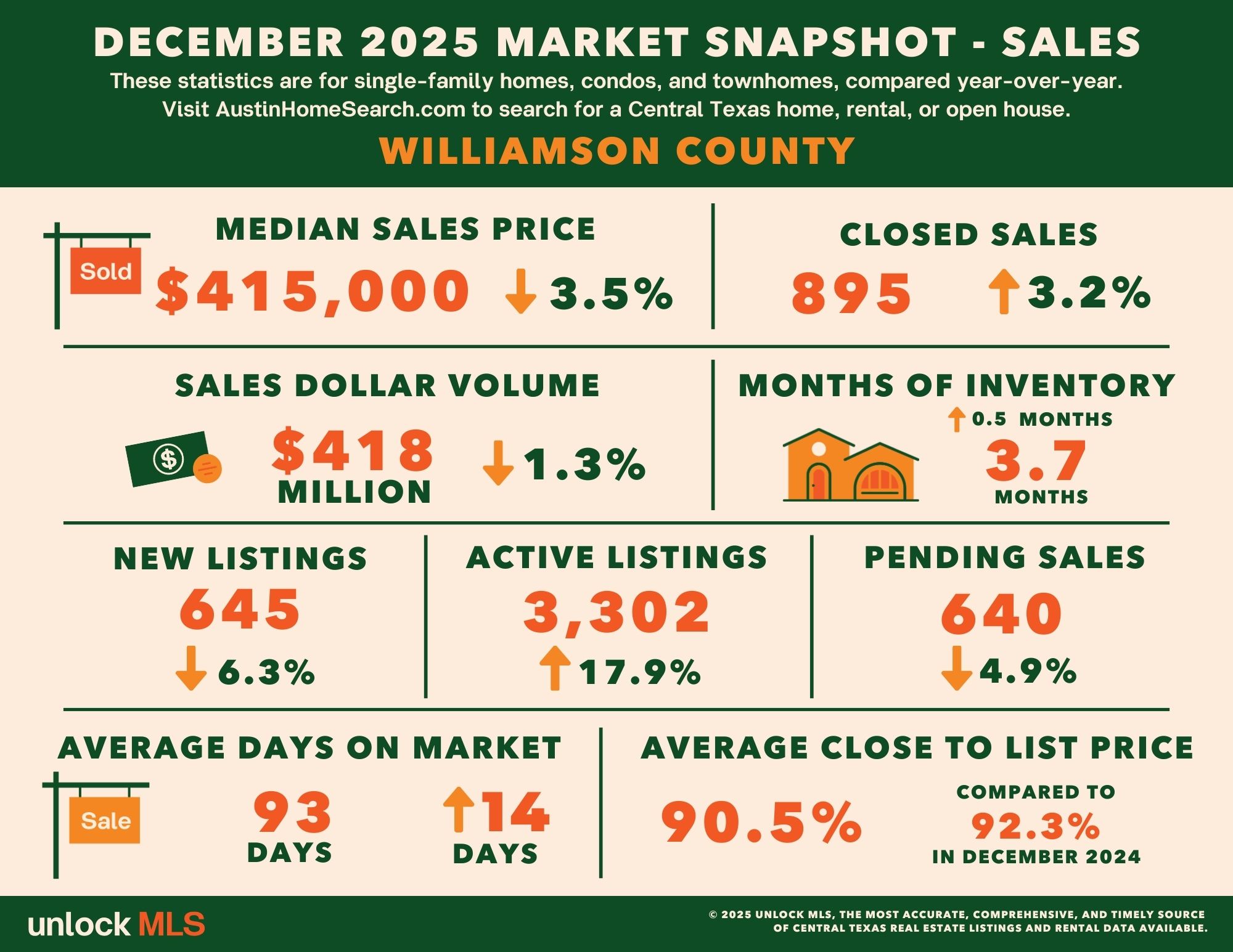

Williamson County (December)

895 – Residential homes sold, 3.2% more than December 2024.

$415,000 – Median price for residential homes, 3.5% less than December 2024.

645 – New home listings on the market, 6.3% less than December 2024.

3,302 – Active home listings on the market, 17.9% more than December 2024.

640 – Pending sales, 4.9% less than December 2024.

3.7 – Months of inventory, 0.5 months more than December 2024.

$418,638,137 – Total dollar volume of homes sold, 1.3% less than December 2024.

90.5% – Average close to list price, compared to 92.3% in December 2024.

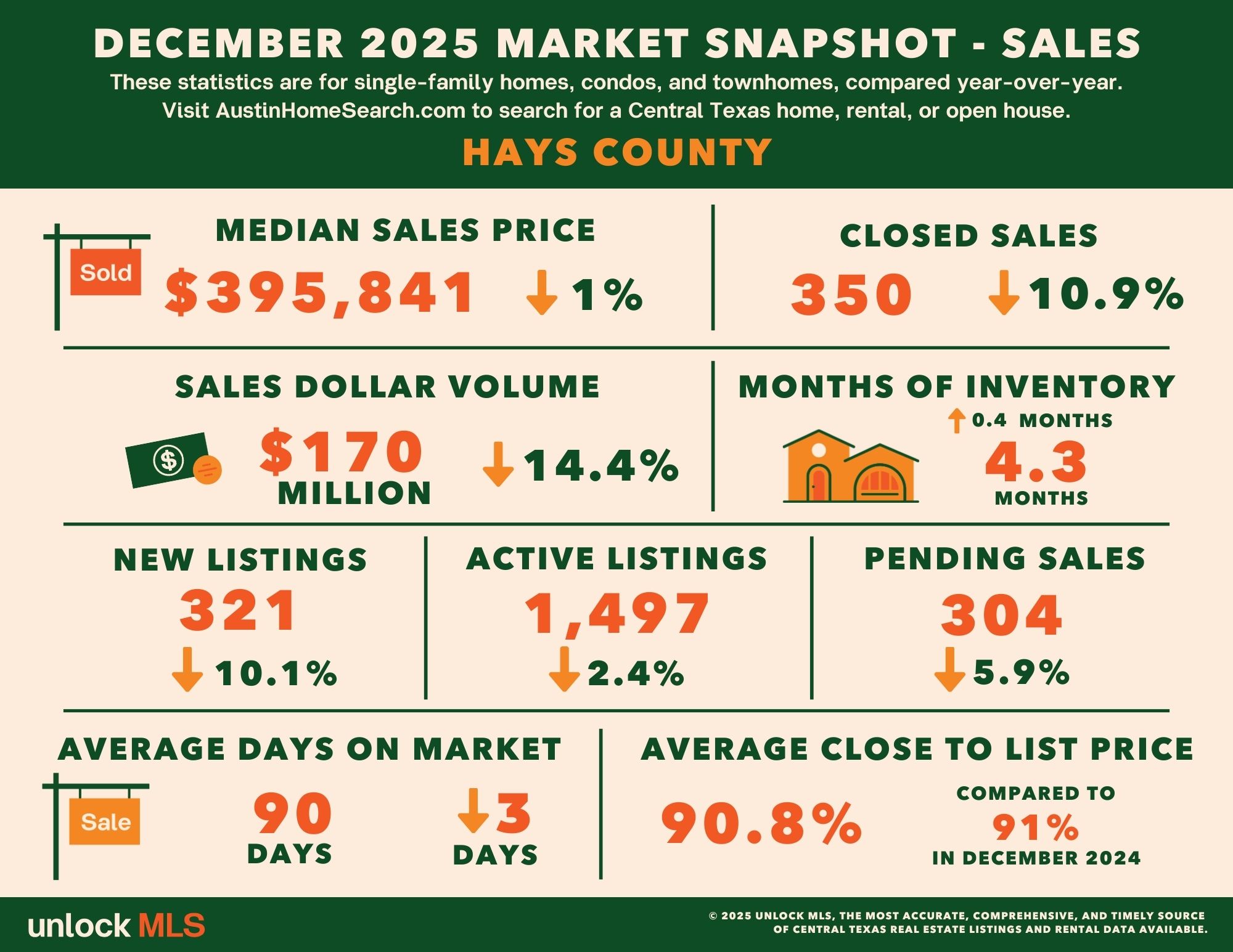

Hays County (December)

350 – Residential homes sold, 10.9% less than December 2024.

$395,000 – Median price for residential homes, 1.0% less than December 2024.

321 – New home listings on the market, 10.1% less than December 2024.

1,497 – Active home listings on the market, 2.4% less than December 2024.

304 – Pending sales, 5.9% less than December 2024.

4.3 – Months of inventory, 0.4 months more than December 2024.

$170,681,317 – Total dollar volume of homes sold, 14.4% less than December 2024.

90.8% – Average close to list price, compared to 91.0% in December 2024.

(information courtesy of ACTRIS)

National Market Update: January Snapshot

Buyer Activity Heating Up

Buyers came out strong to start the year. According to the Mortgage Bankers Association, purchase mortgage applications for the week ending January 16 were up 12% from the week before and a full 18% above the same time last year. Freddie Mac also reported a nearly 1% drop in the average 30-year fixed mortgage rate year-over-year, which helped bring more homeowners and sellers back to the market.

Even Freddie Mac’s Chief Economist noted that both purchase and refinance activity have jumped, calling it a “clear sign housing activity is improving and poised for a solid spring season.”

Sales, Prices & Inventory

After a strong November, Pending Home Sales dropped 9.3% in December, dragging the annual number down by 3.0% for 2025. But it’s worth noting that December inventory levels were the lowest of the year, limiting choices for buyers and potentially inflating that drop.

Meanwhile, Existing Home Sales rose 5.1% in December, the biggest monthly gain in nearly three years, and New Home Sales were up 18.7% year-over-year as of October. New construction supply is now up 300% from the 2022 bottom, and median new home prices are down nearly 15% from their peak.

Price growth overall continues to cool:

> Case-Shiller Index (October): +1.4%

> FHFA Index: Slowing price gains expected

> Wages are now outpacing home prices, improving affordability nationwide

Affordability Trends

> Homebuyers now need about 7 years to save for a down payment, down from 12 years in 2022 (per Realtor.com)

> Mortgage rates remain at 3-year lows

> Personal income rose 4.3%, while spending climbed 5.4% over the past year

> The Mortgage Credit Availability Index is at its highest level in 3 years, signaling more options for borrowers

Inflation & Fed Outlook

The Fed’s preferred inflation gauge, Core PCE, held steady at 2.8% year-over-year in November, matching September and still above the 2.0% target. CPI (consumer prices) remained flat in December, while PPI (wholesale prices) ticked slightly higher—disappointing traders hoping for a bigger drop.

Still, gas prices have fallen, and consumer confidence is trending up. Economists expect:

> No rate change this month

> A likely rate cut in March

> Another hold in April

Jobs & Labor Market

Despite headlines about hiring slowdowns, the labor market remains strong:

> Initial jobless claims were at 200,000, in line with 2019 norms

> Continuing claims dropped to 1.849 million

> The four-week average for jobless claims fell to its lowest level in two years

This data shows companies are hesitant to lay off workers, even if hiring has cooled—an encouraging sign for housing market resilience

If your interest in the market is tied to a future move or downsizing decision, you can find more guidance here: Senior Downsizing in the Austin Area.

Selling in the Austin Area?

Let’s Make It a Smart Move.

From pricing to closing, I help sellers take the guesswork out of the process and

walk away with the strongest possible outcome.

Buying a Home in Austin?

Let’s Craft a Smarter Game Plan.

From first-time buyers to seasoned movers, I help clients navigate Austin’s fast-moving market with strategy, straight talk, and no wasted steps.

Every Great Sale Starts

with a Clear Goal

Are you after a fast close? Maximum price? Flexible timeline? There’s no one-size-fits-all strategy. That’s why I start by understanding your "why."

Once you know your priorities and your walkaway point, every other decision gets easier—from pricing to negotiation. If you're not sure yet, I help you get clear, fast.

Want the Game Plan?

This isn’t just another checklist. It’s a strategy-packed guide that breaks down what actually works when selling your home in today’s market.

No pressure. No sales tactics. Just a process built around your priorities.

Want the Game Plan?

This isn’t just another checklist. These are strategy-packed guides that breaks down what actually works when selling or buying a home in today’s market.

Every Great Sale Starts

with a Clear Goal

Are you after a fast close? Maximum price? Flexible timeline? There’s no one-size-fits-all strategy. That’s why I start by understanding your "why."

Once you know your priorities and your walkaway point, every other decision gets easier—from pricing to negotiation. If you're not sure yet, I help you get clear, fast.

Want the Game Plan?

This isn’t just another checklist. It’s a strategy-packed guide that breaks down what actually works when selling your home in today’s market.

Smart Sellers Follow a Proven Process

Clarify Your Motivation

Are we optimizing for price, speed, or terms?

Prep the Home

Maximize strengths. Minimize distractions. Make buyers want to stay.

Price it Strategically

Not too high, not too low - we position it to win attention and offers.

Market with Purpose

Online, offline, social, and syndication - I go where buyers are.

Negotiate Like a Pro

I help you read the offer behind the offer and counter with confidence.

Close Clean

We handle contracts, timelines, inspections, and walk-throughs without drama.

Before You List, Watch This.

Get the Guides That

Make Selling Simpler

I’ve put together a set of free, no-fluff guides that walk you through everything from preparing your home to moving day. Whether you're a first-time seller or just want a sharper plan, these are packed with real insight - not recycled internet checklists.

Just click and download what you need, or grab the whole set.

James Brinkman – Broker, Realtor, SRES, CRS, CNE | Homes By Brink

3103 Bee Caves Rd STE 102, Rollingwood, TX 78746

(512) 698-3525

Homes by Brink | Copyright © 2025 | All Rights Reserved

Privacy Policy l Terms & Condition|Disclosure

Homes By Brink

Homes by Brink | Copyright © 2025 | All Rights Reserved

Privacy Policy l Terms & Condition|Disclosure